How Do I Apply For Homestead Credit In Arkansas . the amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. There are 3 ways to apply for the homestead credit, they are as follows: how do i apply for homestead credit? a homestead is defined as a dwelling used as the property owner’s principal place of residence. Provides up to $500 tax credit on property that is the owner's primary place of residence. Counties give the tax credit to. What is the homestead tax credit? Also known as amendment 79, it was passed by the. Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. amendment 79 to the arkansas state constitution provides for a homestead property tax credit of up to $500 for. Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year.

from exoulfgvh.blob.core.windows.net

Counties give the tax credit to. how do i apply for homestead credit? Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. a homestead is defined as a dwelling used as the property owner’s principal place of residence. Provides up to $500 tax credit on property that is the owner's primary place of residence. the amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. Also known as amendment 79, it was passed by the. amendment 79 to the arkansas state constitution provides for a homestead property tax credit of up to $500 for. What is the homestead tax credit? There are 3 ways to apply for the homestead credit, they are as follows:

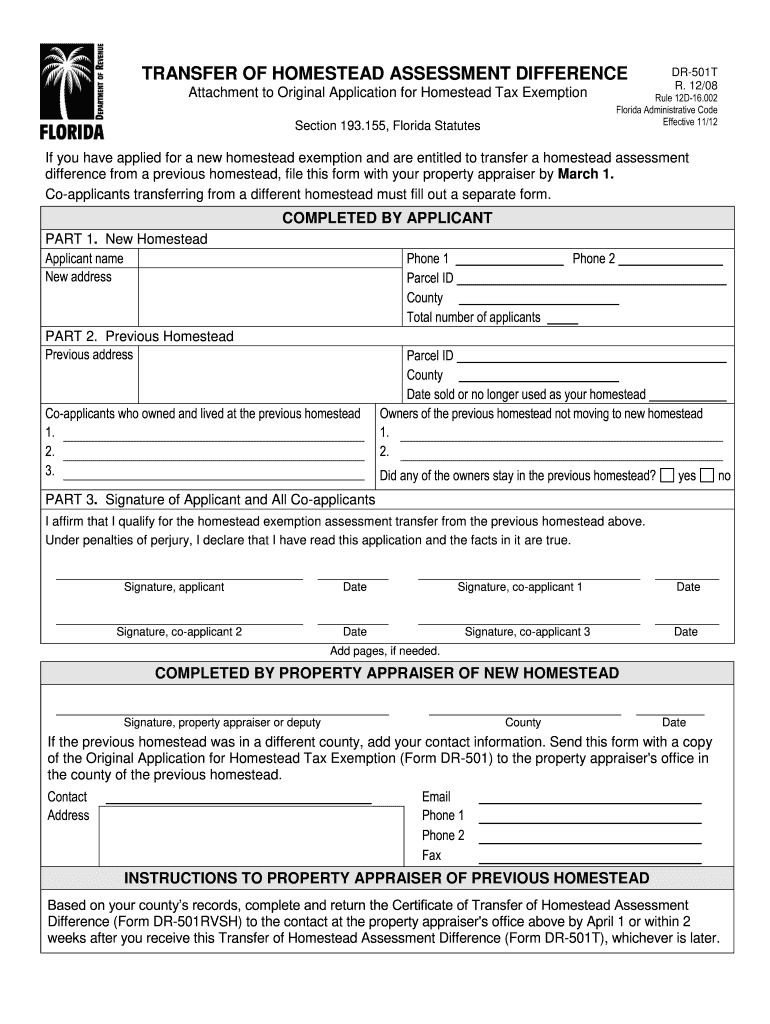

What Homestead Exemption Florida at Lisa Wolf blog

How Do I Apply For Homestead Credit In Arkansas What is the homestead tax credit? Also known as amendment 79, it was passed by the. Counties give the tax credit to. the amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. There are 3 ways to apply for the homestead credit, they are as follows: how do i apply for homestead credit? What is the homestead tax credit? Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. amendment 79 to the arkansas state constitution provides for a homestead property tax credit of up to $500 for. Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. a homestead is defined as a dwelling used as the property owner’s principal place of residence. Provides up to $500 tax credit on property that is the owner's primary place of residence.

From www.theseasonalhomestead.com

QuarterAcre Garden Plans 2020 The Seasonal Homestead How Do I Apply For Homestead Credit In Arkansas Counties give the tax credit to. Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. What is the homestead tax credit? a homestead is defined as a dwelling used as the property owner’s principal place of residence. the amount of property tax owed is based on the assessed value of the. How Do I Apply For Homestead Credit In Arkansas.

From www.dochub.com

How to apply for homestead credit in arkansas online Fill out & sign How Do I Apply For Homestead Credit In Arkansas the amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. amendment 79 to the arkansas state constitution provides for a homestead property tax credit of up to $500 for. There are 3 ways to apply for the homestead credit, they are as follows: What is the. How Do I Apply For Homestead Credit In Arkansas.

From www.megadox.com

California Homestead Declaration Form for single person Legal Forms How Do I Apply For Homestead Credit In Arkansas Provides up to $500 tax credit on property that is the owner's primary place of residence. There are 3 ways to apply for the homestead credit, they are as follows: Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. the amount of property tax owed is based on the assessed value of. How Do I Apply For Homestead Credit In Arkansas.

From www.montgomerycountymd.gov

Homestead Tax Credit How Do I Apply For Homestead Credit In Arkansas Counties give the tax credit to. a homestead is defined as a dwelling used as the property owner’s principal place of residence. There are 3 ways to apply for the homestead credit, they are as follows: amendment 79 to the arkansas state constitution provides for a homestead property tax credit of up to $500 for. how do. How Do I Apply For Homestead Credit In Arkansas.

From ar.inspiredpencil.com

Exemption How Do I Apply For Homestead Credit In Arkansas the amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. amendment 79 to the arkansas state constitution provides for a homestead property tax credit of up to $500 for. how do i apply for homestead credit? There are 3 ways to apply for the homestead. How Do I Apply For Homestead Credit In Arkansas.

From www.formsbank.com

Application For Homestead Property Tax Exemption Form printable pdf How Do I Apply For Homestead Credit In Arkansas Provides up to $500 tax credit on property that is the owner's primary place of residence. Counties give the tax credit to. Also known as amendment 79, it was passed by the. Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. There are 3 ways to apply for the homestead credit, they are. How Do I Apply For Homestead Credit In Arkansas.

From www.youtube.com

Arkansas Homestead Tax Credit w/ Chrissy Dougherty (Executive Broker How Do I Apply For Homestead Credit In Arkansas Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. Counties give the tax credit to. Also known as amendment 79, it was passed by the. the amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. Provides up to $500 tax. How Do I Apply For Homestead Credit In Arkansas.

From wilowqguinevere.pages.dev

Homestead Form 2024 Taryn Francyne How Do I Apply For Homestead Credit In Arkansas a homestead is defined as a dwelling used as the property owner’s principal place of residence. how do i apply for homestead credit? amendment 79 to the arkansas state constitution provides for a homestead property tax credit of up to $500 for. Counties give the tax credit to. There are 3 ways to apply for the homestead. How Do I Apply For Homestead Credit In Arkansas.

From exoswvnyl.blob.core.windows.net

Is Wisconsin A High Tax State at John Edwards blog How Do I Apply For Homestead Credit In Arkansas Counties give the tax credit to. Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. the amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. amendment 79 to the arkansas state constitution provides for a homestead property tax credit. How Do I Apply For Homestead Credit In Arkansas.

From legaltemplates.net

Free Arkansas Quitclaim Deed Form PDF & Word How Do I Apply For Homestead Credit In Arkansas There are 3 ways to apply for the homestead credit, they are as follows: amendment 79 to the arkansas state constitution provides for a homestead property tax credit of up to $500 for. a homestead is defined as a dwelling used as the property owner’s principal place of residence. Homeowners in arkansas may receive a homestead property tax. How Do I Apply For Homestead Credit In Arkansas.

From www.montgomerycountymd.gov

Homestead Tax Credit How Do I Apply For Homestead Credit In Arkansas Counties give the tax credit to. There are 3 ways to apply for the homestead credit, they are as follows: amendment 79 to the arkansas state constitution provides for a homestead property tax credit of up to $500 for. What is the homestead tax credit? how do i apply for homestead credit? the amount of property tax. How Do I Apply For Homestead Credit In Arkansas.

From ceuawfyx.blob.core.windows.net

Alabama Tax Deed Property at Diane Cole blog How Do I Apply For Homestead Credit In Arkansas the amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. What is the homestead tax credit? Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. amendment 79 to the arkansas state constitution provides for a homestead property tax credit. How Do I Apply For Homestead Credit In Arkansas.

From exokrmspt.blob.core.windows.net

How To Apply For Homestead Exemption In Johnson County Texas at David How Do I Apply For Homestead Credit In Arkansas Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. Also known as amendment 79, it was passed by the. a homestead is defined as a dwelling used as the property owner’s principal place of residence. . How Do I Apply For Homestead Credit In Arkansas.

From www.formsbank.com

Fillable Form 24757 Homestead Credit Application For Senior Citizens How Do I Apply For Homestead Credit In Arkansas There are 3 ways to apply for the homestead credit, they are as follows: What is the homestead tax credit? Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. Provides up to $500 tax credit on property that is the owner's primary place of residence. Homeowners in arkansas may receive a homestead property. How Do I Apply For Homestead Credit In Arkansas.

From www.templateroller.com

Maryland Application for Homestead Tax Credit Eligibility Fill Out How Do I Apply For Homestead Credit In Arkansas There are 3 ways to apply for the homestead credit, they are as follows: What is the homestead tax credit? Counties give the tax credit to. a homestead is defined as a dwelling used as the property owner’s principal place of residence. amendment 79 to the arkansas state constitution provides for a homestead property tax credit of up. How Do I Apply For Homestead Credit In Arkansas.

From www.dochub.com

Wisconsin homestead credit form 2023 Fill out & sign online DocHub How Do I Apply For Homestead Credit In Arkansas What is the homestead tax credit? Also known as amendment 79, it was passed by the. Provides up to $500 tax credit on property that is the owner's primary place of residence. amendment 79 to the arkansas state constitution provides for a homestead property tax credit of up to $500 for. Homeowners in arkansas may receive a homestead property. How Do I Apply For Homestead Credit In Arkansas.

From www.theselfsufficienthomeacre.com

Wanna Go Homesteady? Part 1 The Self Sufficient HomeAcre How Do I Apply For Homestead Credit In Arkansas a homestead is defined as a dwelling used as the property owner’s principal place of residence. Counties give the tax credit to. how do i apply for homestead credit? What is the homestead tax credit? There are 3 ways to apply for the homestead credit, they are as follows: the amount of property tax owed is based. How Do I Apply For Homestead Credit In Arkansas.

From www.theseasonalhomestead.com

Getting Started with a Year Round Garden Part 2 Layout The Seasonal How Do I Apply For Homestead Credit In Arkansas There are 3 ways to apply for the homestead credit, they are as follows: the amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. What is the homestead tax credit? Counties. How Do I Apply For Homestead Credit In Arkansas.